Prescription Drug Plans

Medicare Part D helps cover the cost of prescription drugs. These plans are offered by private insurance companies approved by Medicare, and they provide access to medications that Original Medicare does not cover.

How does Medicare Part D Work?

Part D is available as a stand-alone plan (PDP) that works with Original Medicare and Medicare Supplement (Medigap) OR it may be included in most Medicare Advantage Plans (MAPD)

Each plan has a formulary (list of covered drugs), divided into cost tiers.

You typically pay a monthly premium, along with copayments and coinsurance when you fill prescriptions.

Key Costs to Understand

Monthly Premium - Amount you pay to have the plan.

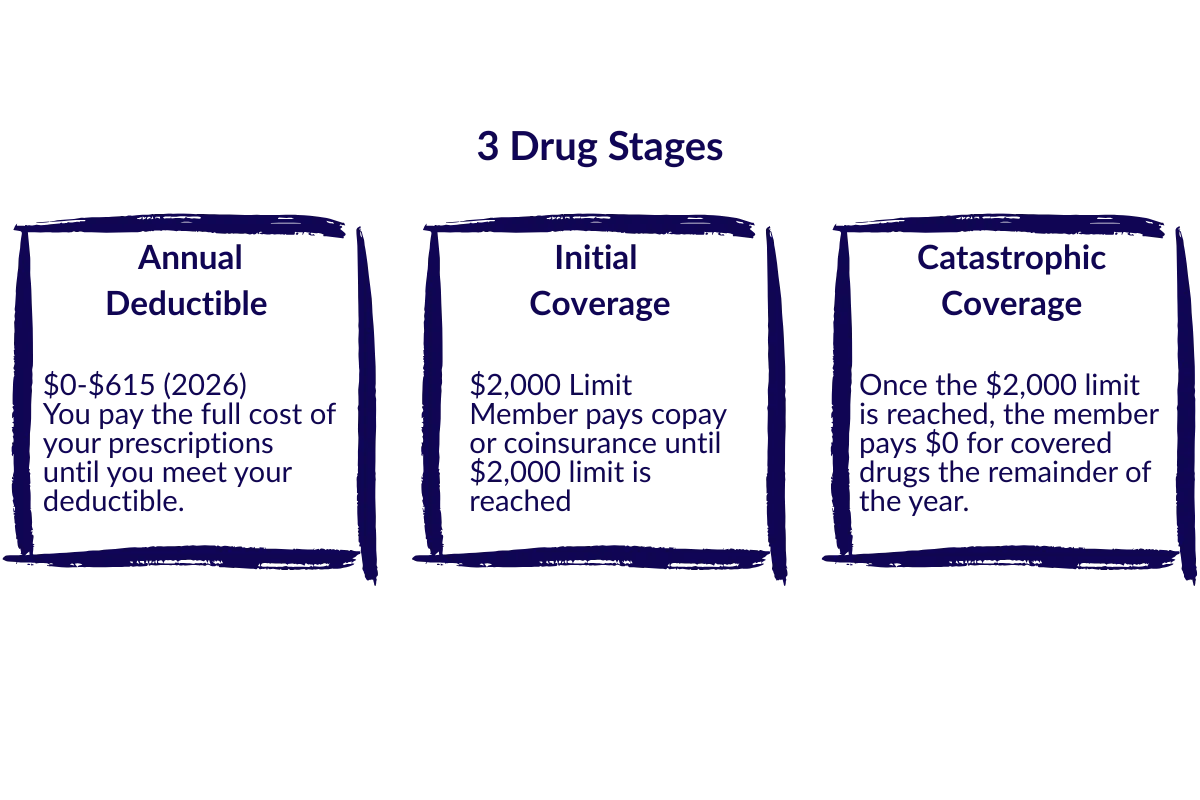

Annual Deductible - What you pay out of pocket before the plan begins sharing costs (some plans waive this for lower tier drugs.)

Copayments/Coinsurance - your share of the cost for each prescription

Annual Maximum Out of Pocket- temporary limit on what the plan covers for drug costs once you and the plan reach a certain level of spending each year.

Late Enrollment Penalty - if you don't sign up for part D (or have other credible prescription drug coverage) when you're first eligible, you may have to pay a permanent penalty.

Calculate the Late Enrollment penalty amount: (this penalty lasts as long as you have part D coverage).

Multiply 1% (or 0.01) by the national base beneficiary premium ($36.78 for 2025).

Multiply that result by the number of your uncovered months

If you go without creditable prescription drug coverage for 63+ days, you may face a permanent penalty added to your premium.

EXAMPLE: If someone delayed enrolling in Medicare Part D and went 10 months without creditable coverage, their late enrollment penalty would be:

10 months × 1% × $36.78 = $3.68 (rounded to $3.70)

So the person would pay an extra $3.70 per month, in addition to their plan’s premium (if applicable), for as long as they have Part D coverage.

Checking Medications

Always confirm whether your prescriptions are covered in the plans formulary.

Different plans may cover drugs differently, or place them in different cost tiers.

Pharmacies in a preferred network may offer lower costs than a standard or out of network pharmacies.

Eligibility & Enrollment

You are eligible for Part D if you are enrolled in Medicare Parts A and/or Part B.

Initial Enrollment Period (IEP): - When you first become eligible for Medicare.

Annual Enrollment Period (AEP): - October 15th - December 7th each year.

Special Enrollment Period (SEPs): - Triggered by certain events, like moving or losing other coverage.

Why Part D Matters

Helps lower the cost of both brand-name and generic drugs.

Provides financial protection against unexpected high prescription costs.

Ensures access to necessary medications for ongoing health conditions.

Need Help with Part D?

© AdviseCare Insurance 2026 All Rights Reserved. AdviseCare Insurance is not connected with or endorsed by the U.S. government or the Federal Medicare Program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. This information is for educational purposes only and is not intended to recommend or endorse any specific plan. Plan availability, benefits, premiums, copayments, and coinsurance amounts vary by carrier and location.