Medicare Supplement (Medigap)

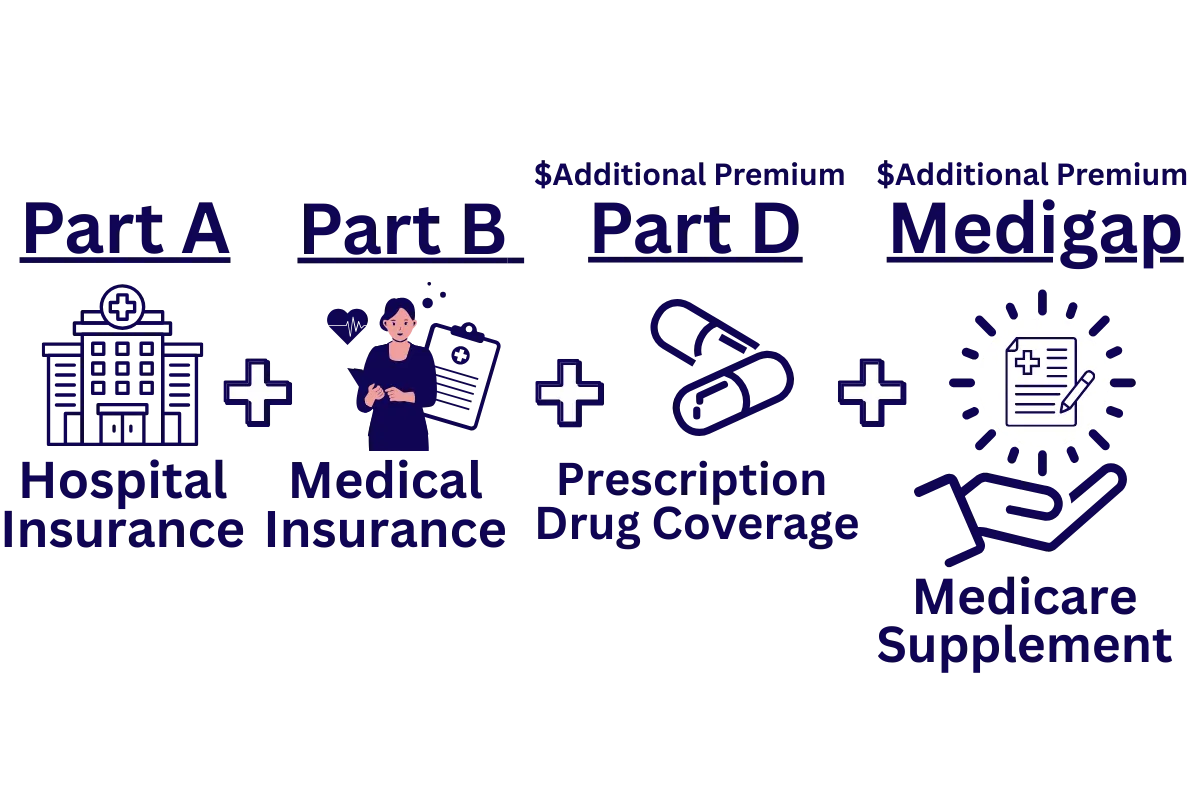

Medicare Supplement Insurance, also called Medigap, helps pay for the out-of-pocket costs that Original Medicare doesn’t cover, such as deductibles, copayments, and coinsurance. These plans are offered by private insurance companies but are standardized and regulated by the federal government.

Part A

Hospital

Part B

Medical

Plan F,G,N...

Medigap

Part D

Prescriptions

How Does Medicare Supplement (Medigap) Work?

Medigap plans are designed to work alongside original medicare (Parts A & B).

Keep your medicare (red, white, and blue card), and your medigap plan pays its share after Medicare pays.

These plans do not replace medicare, they "fill in the gaps."

You must remain enrolled in both Part A & Part B to keep medigap coverage.

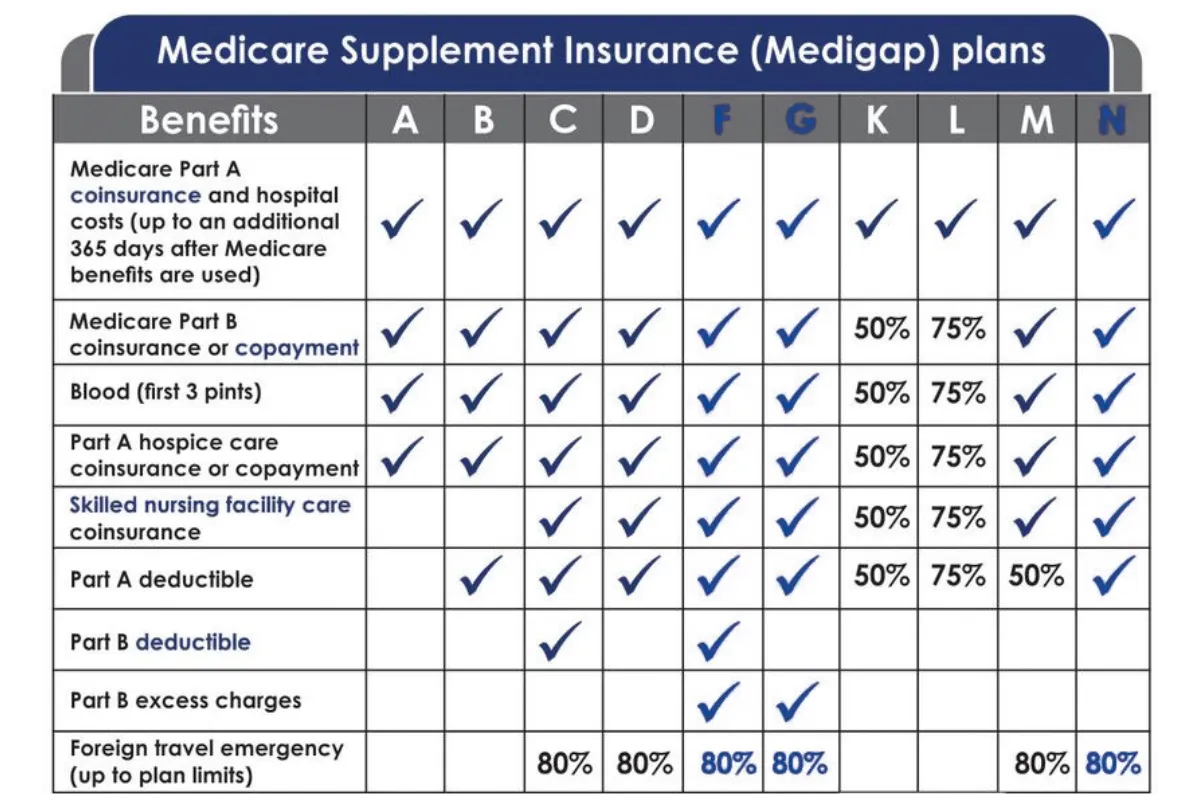

Plan Options

Medigap plans are standardized across most states (plans are labeled A through N).

Each lettered plan offers the same benefits, no matter which insurance company sells it.

The difference is which benefits are included and the monthly premium cost.

Examples of what Medigap may cover:

Medicare Part A coinsurance and hospital costs

Medicare Part B coinsurance and hospital costs.

Blood (first 3 pints)

Hospice care coinsurance

Skilled nursing facility coinsurance

Part A and Part B deductibles (depending on the plan)

Foreign travel emergency coverage

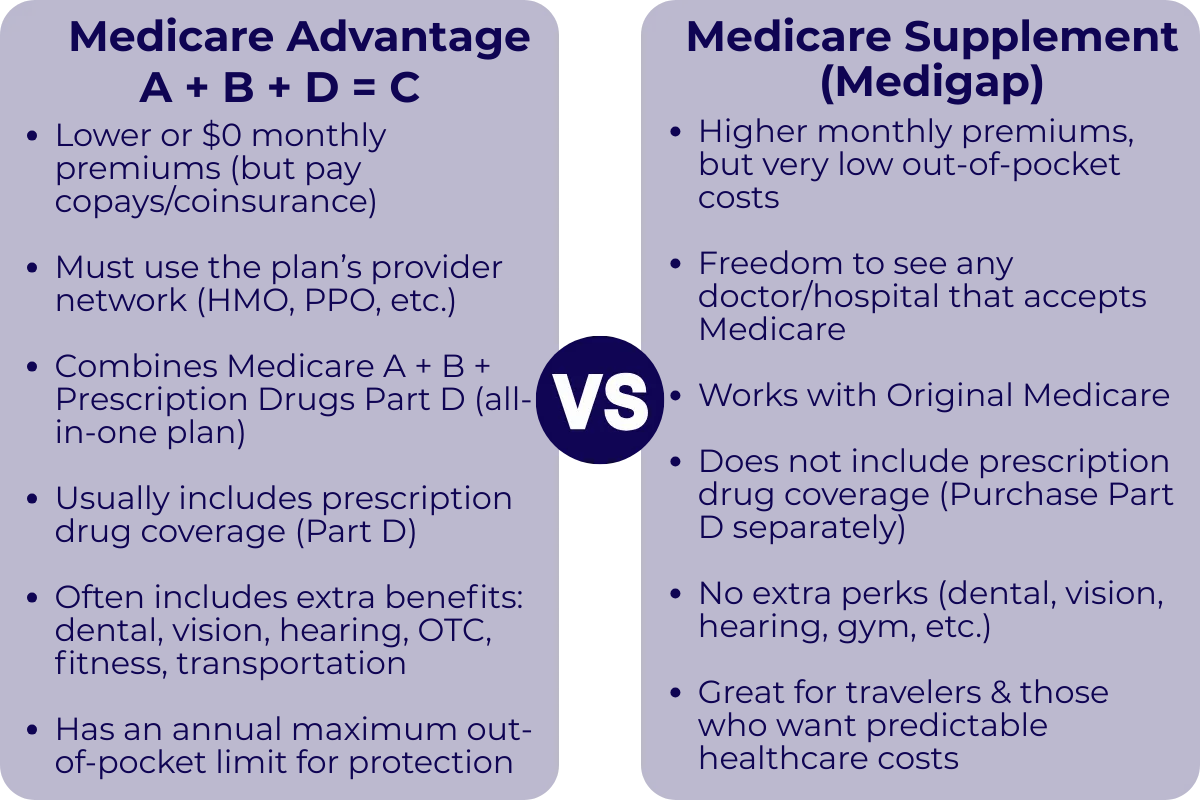

Medigap vs. Medicare Advantage

Medigap = Supplement Original Medicare

Medicare Advantage = Alternative to Original Medicare

You cannot have both medigap and medicare advantage at the same time.

Many people choose medigap if they want:

Freedom to see any doctor that accepts medicare, nationwide

More predictable out of pocket costs

Medigap FAQs

Do Medigap plans include prescription drug coverage?

No. You will need to purchase separate Part D plan for prescription drugs.

What is the best time to buy Medigap?

During your Medigap Open Enrollment Period (6 months starting the month you're 65 and enrolled into Part B.) During this time, you cannot be denied coverage or charged more due to health history.

Can I Switch Medigap plans later?

Yes, but depending on your health and state rules, you may be subject to medical underwriting outside of your open enrollment window.

© AdviseCare Insurance 2026 All Rights Reserved. AdviseCare Insurance is not connected with or endorsed by the U.S. government or the Federal Medicare Program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. This information is for educational purposes only and is not intended to recommend or endorse any specific plan. Plan availability, benefits, premiums, copayments, and coinsurance amounts vary by carrier and location.