Why Consider Ancillary Coverage?

Ancillary plans fill the coverage gaps that Medicare and Medicare Advantage plans can sometimes leave behind. They provide financial protection against unexpected medical bills while adding flexibility and peace of mind for you and your family.

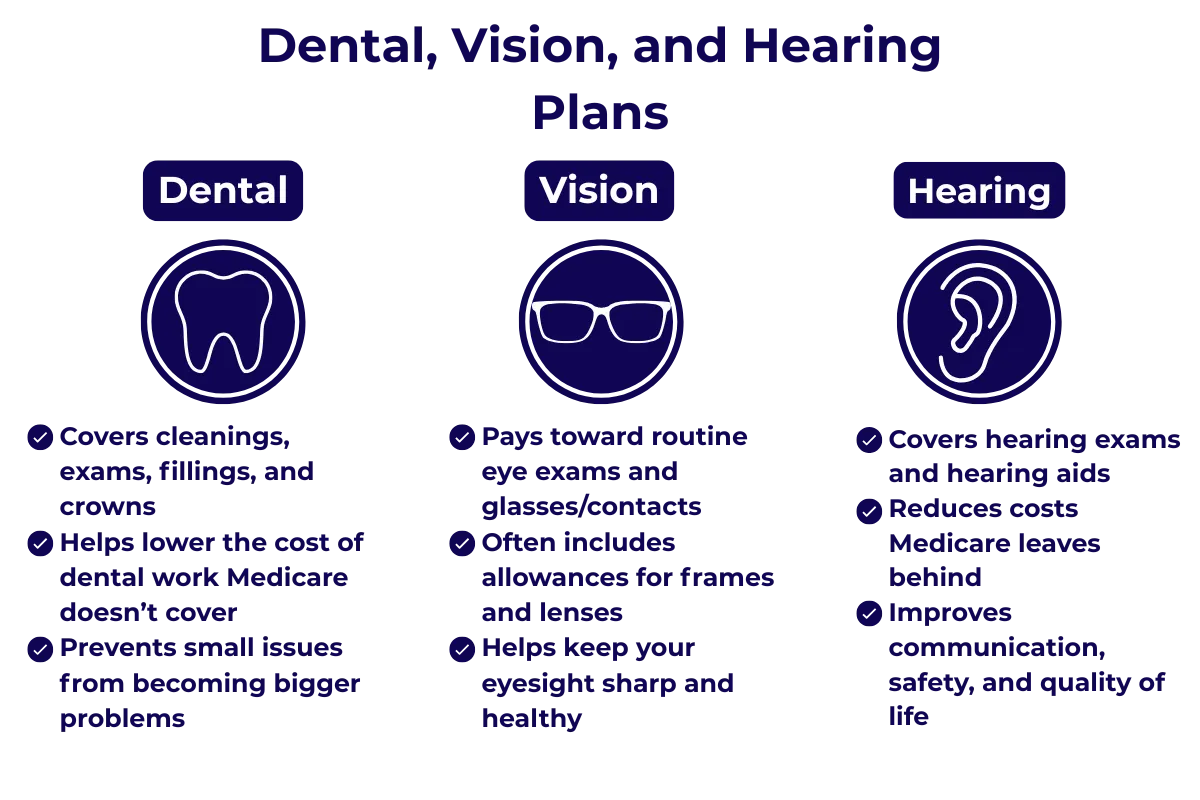

Dental, Vision, & Hearing (DVH)

Dental: May include coverage for cleanings, exams, fillings, crowns, or dentures.

Vision: Helps with eye exams, glasses, and contact lenses.

Hearing: Covers hearing exams and may help with the cost of hearing aids.

Note: DVH plans are popular because most Medicare plans provide only limited or no coverage for these services.

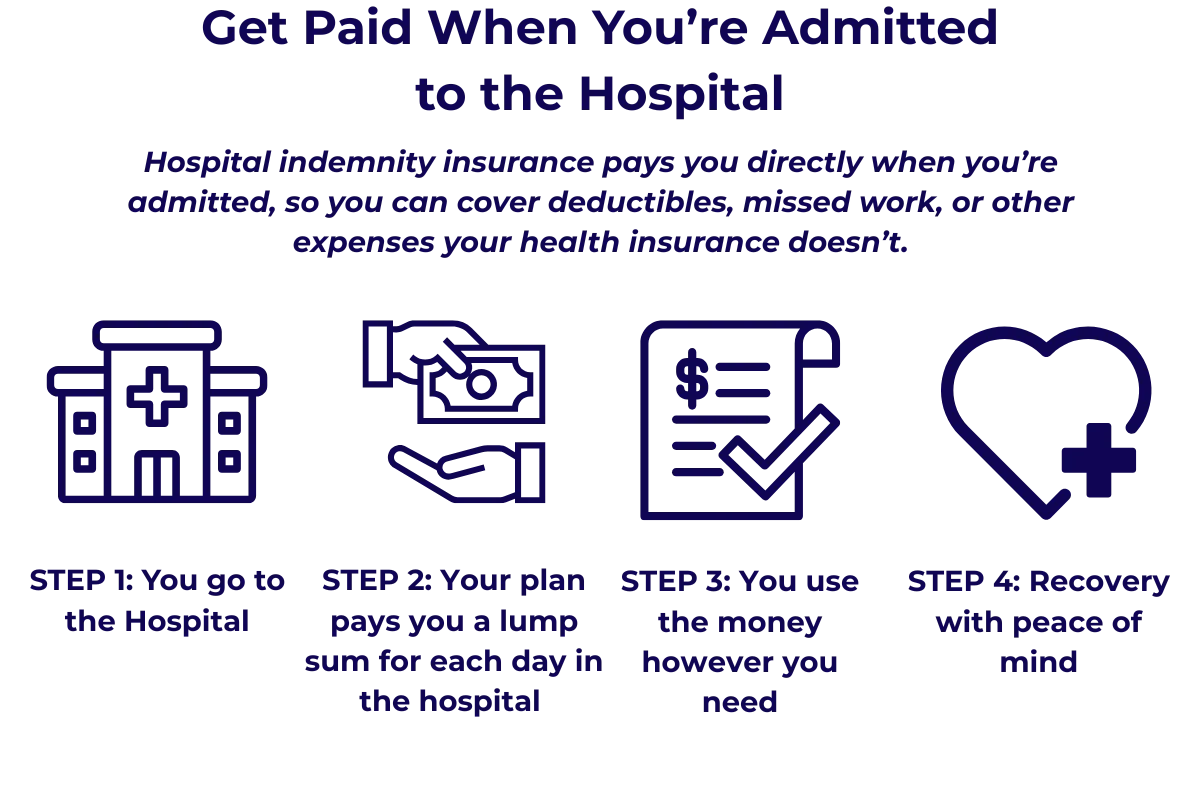

Hospital Indemnity Plans

Pays cash benefit directly to you when you are admitted to a hospital.

Helps cover copays, deductibles, or non-medical expenses (like travel or bills while you recover).

Often Flexible - you decide how to use the funds.

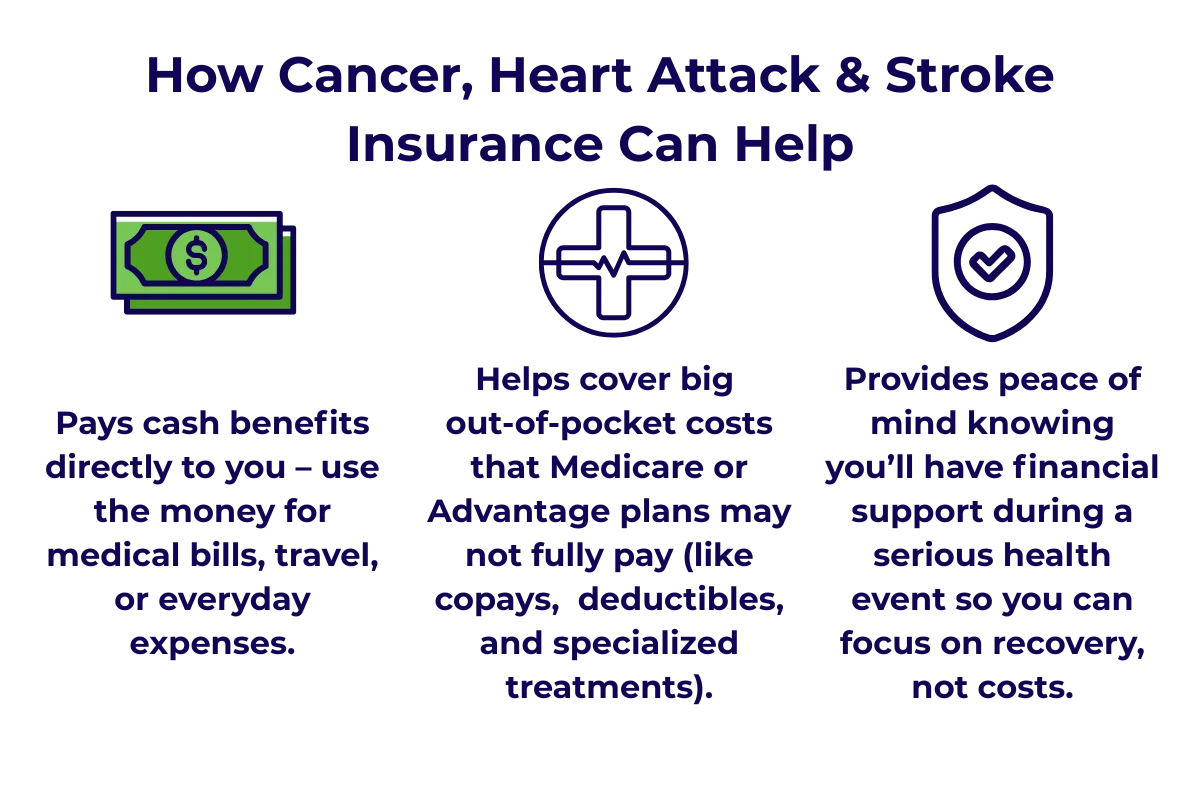

Cancer, Heart Attack & Stroke Plans

Provide a lump-sum cash benefit if you are diagnosed with one of these major conditions.

Money Can be used for:

Medical bills not covered by Medicare.

Out-of-pocket costs.

Everyday expenses while you are unable to work.

Helps protect against the high financial impact of serious illnesses.

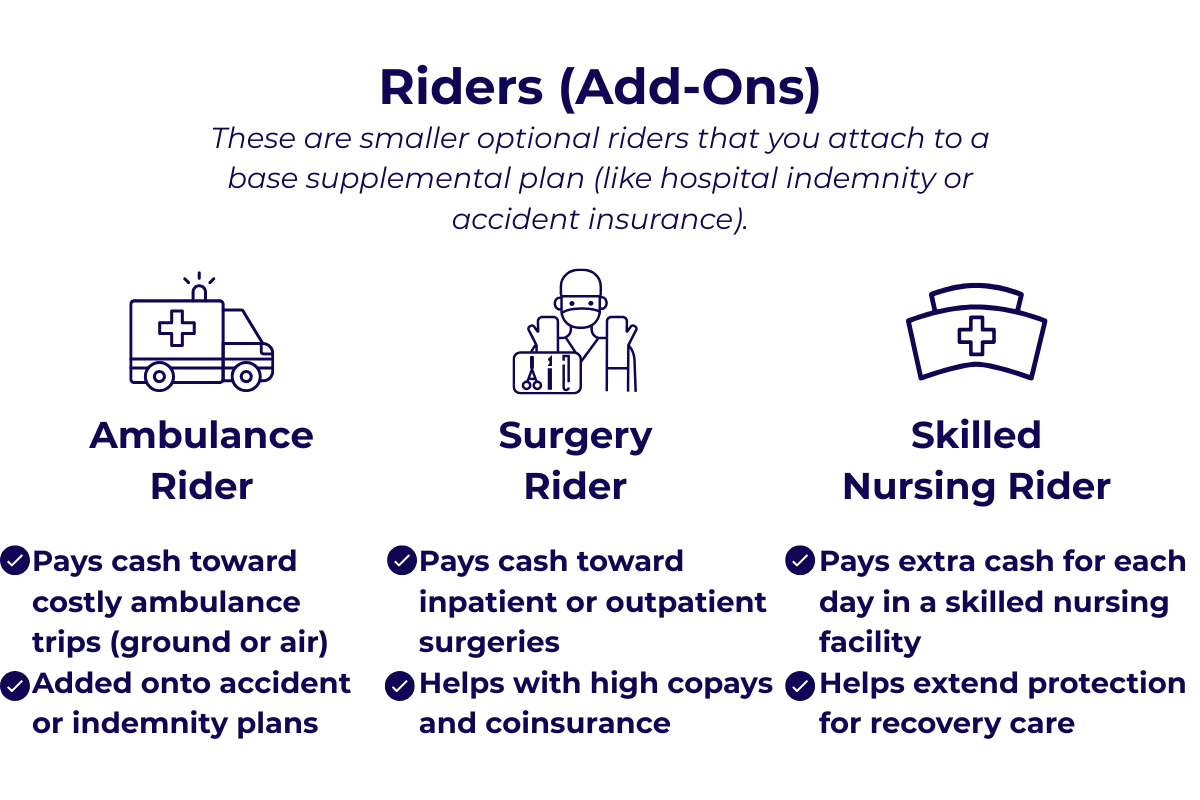

Additional Riders/Specialty Coverage

Some plans may offer riders or additional policies for:

Critical Illness coverage

Accident protection

Short-term recovery care

Final Expense (to help cover funeral and burial costs)

© AdviseCare Insurance 2026 All Rights Reserved. AdviseCare Insurance is not connected with or endorsed by the U.S. government or the Federal Medicare Program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. This information is for educational purposes only and is not intended to recommend or endorse any specific plan. Plan availability, benefits, premiums, copayments, and coinsurance amounts vary by carrier and location.